An independent research and training institute for Islamic financing, the Bangladesh Institute of Islamic Finance (BIIF) has emerged with the aim of enhancing the professional skills of Islamic banking, capital market, takaful and business professionals of the country.

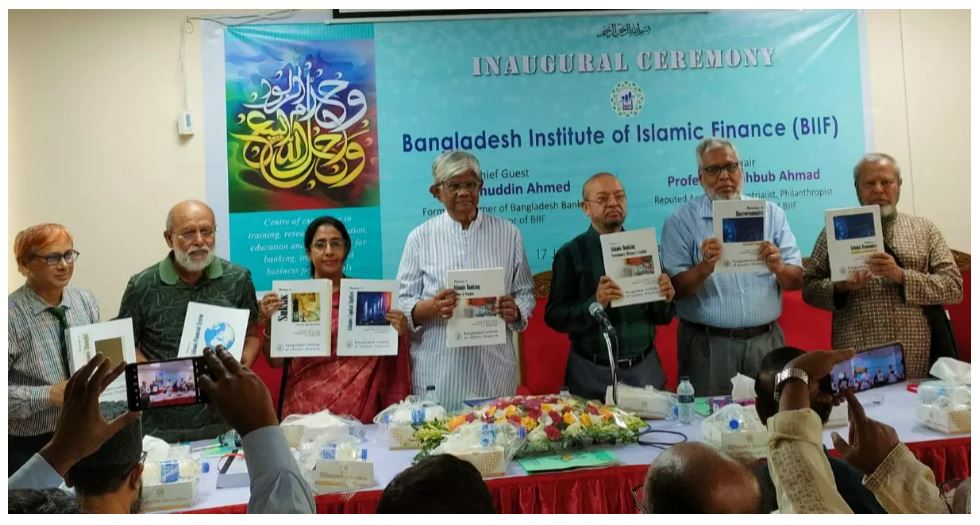

The BIIF started its journey with a festive program at 125, Motijheel, Dhaka on Saturday (June 17). Dr. Salehuddin Ahmed, the former governor of Bangladesh Bank and chief advisor of BIIF was present as the chief guest at the opening ceremony of BIIF. Dr Salehuddin along with other guests inaugurated the BIIF and uncovered a book on Islamic banking.

Dr Salehuddin Ahmed said, Islamic banks can work to encourage youth-led startups for employment by providing investment in nominal profit margin, which is the broader perspective of Islamic finance. higher interest and compound interest work as a barrier for entrepreneurs, this is why Europe and the United States have formed separate equity systems for Islamic financing along with the research panel.

He said there are many Islamic banks and general banks that have opened Islamic banking wings, but quality Islamic banking is lagging behind in line with the global standard, due to lack of knowledge and regulations. He emphasized that Islamic banks work for human welfare, creating opportunities for the deprived in the sense of social justice of Islamic financing.

Dr Salehuddin said, Islamic banking financing is more significant than conventional banking in the country’s economy. Islamic banking is a different approach from conventional banking. It is a complete banking system. Far ahead of traditional banking especially in social activities. This type of bank should be run with caution. Care must be taken in Islamic banking financing. If not, the money of the bank will be smuggled abroad. Still happening Procedures should be followed in this regard.

He said, there is not much mention about Islamic finance in the country’s monetary policy and currency market. Because interest-based matters are described. In reality, monetary policy involves much more than just interest rates. And in Islamic banking there is no opportunity to play a role due to interest. Again, risk cannot be shared through banks, which is not easy to do in the capital market. That is why many are more inclined to bank loans.

Dr Salehuddin said, Islamic banking is beneficial, profitable and good source of financing. However, common people do not have much idea about Sharia terminology. There is no propaganda about it. But campaigning does not mean miking again. Informational campaign should be conducted in this regard. There is no rush. Work should be done to increase trust in banks. As if poor people also become interested in Islamic finance. Because poor people usually don’t have money in the bank. Work should be done to spread Islamic banking. Especially young people need to understand this type of banking. Recently they are moving away from banking. They tend to believe more in earn and enjoy principles. But Islam says your money is not only yours. It has its share of the poor.

Professor Mahbub Ahmed, retired professor of Department of Accounting, Dhaka University, distinguished educationist, philanthropist and founding chairman of BIIF, presided over the event.

Professor Mahbub said Islamic financing should be included in the academic curriculum in the universities, as there are 12 Islamic banks in the country and some other banks have Islamic banking wings. “The world-famous Cambridge and Oxford universities have several disciplines on Islamic financing and banking, so why not in Bangladesh?” — he pointed out.

Dr Muhammad Abdul Mazid, former chairman of the National Board of Revenue (NBR), said Banks are the main source of finance in the country. Again, the contribution of Islamic banks in the banking sector is about 69 percent. But this sector is sick. Time to think about it. In this regard, BIIF will act as a consulting firm and think tank. Due to lack of knowledge and talented human resources, Islamic financing cannot work properly, and training institutes like BIIF can provide diploma programs for Islamic banking and financing.

Dr Muhammad Fouzul Kabir Khan, economist and former secretary to the People’s Republic of Bangladesh, said now in many cases it can be seen that Islam is in the word. Not in reality. Therefore, Islamic banking has to make proper use of Shariah. Investment conditions must be met. It should be checked whether the country’s money is going abroad. Otherwise, Gulshan-3 will be built in Dubai on the model of Gulshan 1 and 2 in Dhaka.

Farid Uddin Ahmed, Chairman of the Executive Committee of Central Sharia Board for Islamic Banks of Bangladesh, said the journey of Islami Bank started with emotion and reality. It can be said that the beginning was with zero. Now 36 banks in the country have Islamic banking. And understanding Islamic banking is always necessary to understand conventional banking. Shariah Bank is playing a role in increasing profitability and viability. Here lies the matter of promise. But now the banks are not able to protect it. Besides, there is no syllabus for this type of banking. These things need to happen. Special importance should be given to Islamic banking like conventional banking.

Professor Dr. Mahmuda Akhtar, Executive President of Bangladesh Institute of Capital Market (BICM); and Professor Dr. Abdul Latif Masum, former VC of Patuakhali Science and Technology University (PSTU), also spoke at the event.

Dr. M. Abdul Aziz, founding director of BIIF gave the welcoming speech at the event. BIIF Senior Research Fellow and Islamic Economist Professor Dr. SM Ali Akkas presented the theme paper. Dr. Taslima Julia, Academic Coordinator of BIIF, gave a power point presentation on BIIF.

Md. Solaiman Mia, Director of BIIF; Dr. Syed Shahid Ahmad, Senior Assistant Director of BIIF; Anisur Rahman Ershad, coordinator (Public Relations) of BIIF; members of the BIIF family and higher officials from Bangladesh Bank and different commercial banks were present on the inaugural ceremony of the BIIF.

Islamic banking and finance sector plays an important role in global economic development. The sector lacks trained manpower capable of practicing Islamic principles as per the demand. In this context, a group of eminent academicians and established business professionals came forward to establish the BIIF.